COLUMBUS, Ohio — While all eyes were turned to the national stage for the presidential race between former President Donald Trump and Vice President Kamala Harris, there were also several important races and a proposed amendment up for a vote in Ohio.

In this election, Ohio voters decided who will win the state's U.S. Senate seat, who will be named to the Ohio Supreme Court and whether an amendment will be passed to establish the Ohio Citizens Redistricting Commission.

In addition, there were several U.S. House, Ohio Supreme Court, Ohio Senate and Ohio House battles.

ELECTION RESULTS: From the presidential race to statewide races and local issues, you can get the latest election results here and on 10TV+, 10TV.com, the 10TV News app.

Ohio races, Issue 1

U.S. Senate

Republican businessman Bernie Moreno defeated Democratic incumbent Sherrod Brown for the U.. Senate seat to represent the state of Ohio.

Justice of Supreme Court

There are six different candidates for the Ohio Supreme Court running for three different races. Depending on the outcome of this race, the court could be under a Democratic majority. Republicans currently have a 4-3 majority.

Ohio Issue 1

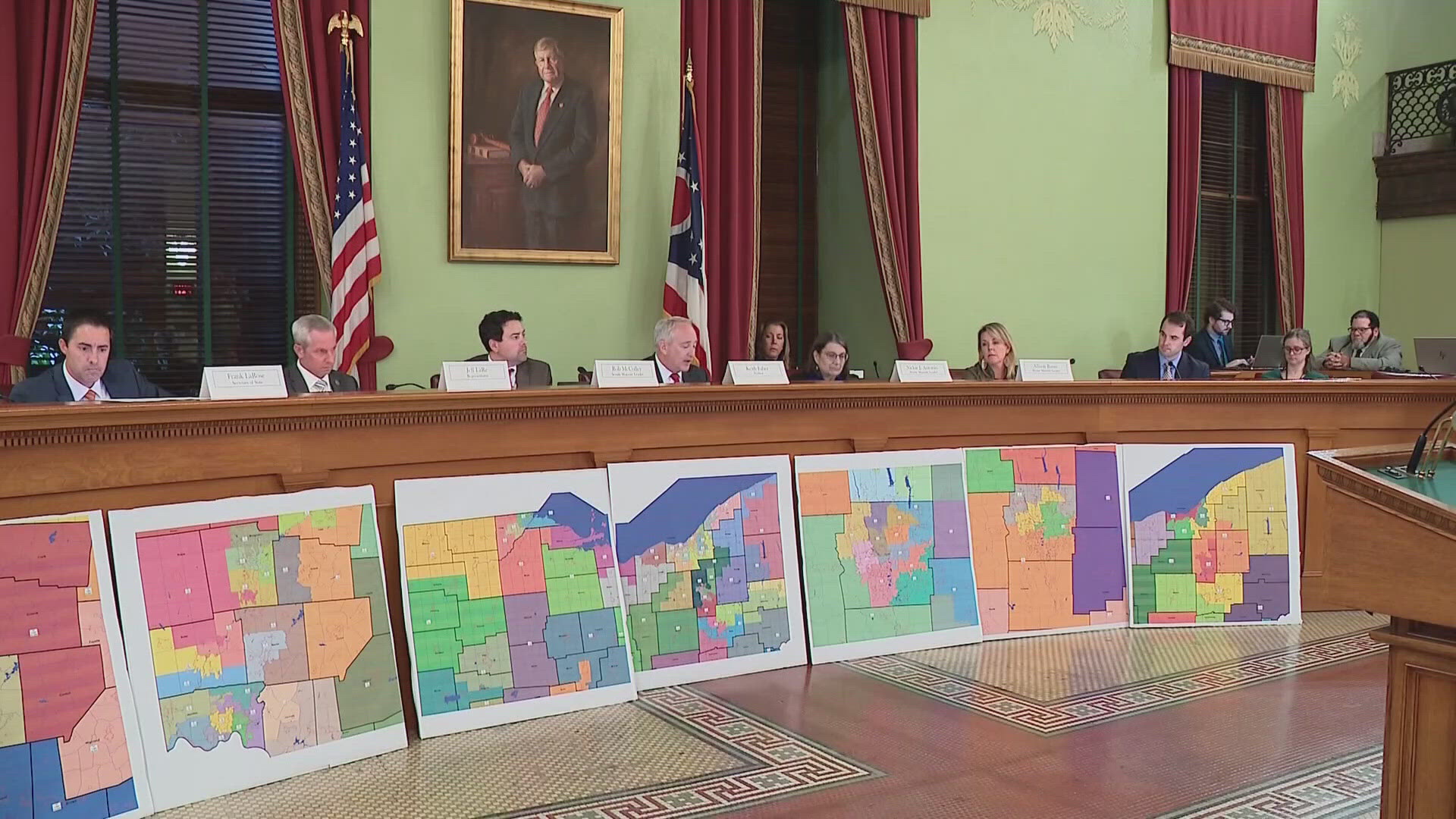

The constitutional amendment aims to replace the current Ohio Redistricting Commission, made up of three statewide officeholders and four state lawmakers, with an independent body selected directly by citizens. The new panel’s members would be diversified by party affiliation and geography.

Central Ohio races, bonds, levies

Central Ohio Transit Authority — Levy to expand transit

The $8 billion levy will increase the local sales tax in Columbus from 7.5% to 8%, increasing COTA's overall share from 0.5% to 1%. That money will generate public funding for the LinkUS initiative. Officials say this would increase COTA services by 45%.

The new services would include five "bus rapid transit" systems stretching across areas like West Broad Street, East Main Street and the northwest corridor. Additionally, the levy creates room for 14 new bus lines and the construction of sidewalks and biking trails. You can read more about the levy here.

Franklin County prosecutor

Democrat Shayla Favor defeated Republican John Rutan in the race to become the Franklin County prosecutor. Favor will take over for Gary Tyack. Favor is Franklin County's first-ever Black and first-ever female prosecutor.

School bonds, levies

The proposal calls for an initial 5 mill tax, followed by annual increases of 2.5 mills in years two through five, spanning from 2025-2029, according to the district. The proposed levy would fund daily, current operational expenses and maintain current academic offerings and student services.

As the buildings in the district near capacity, leaders have put a 4.46 mill bond levy on the ballot to provide funding for a new high school and other district projects. The district is seeking a $100 million bond issue. The projected levy is estimated to cost a Buckeye Valley homeowner $156 annually per $100,000 of assessed property value.

The Board of Education voted to place a $69.5 million bond issue on the ballot, which would go toward the construction of a new Stevenson Elementary School and improvements to the district's K-12 athletic complex. According to the district, the proposed project would be approximately 6.95 mills, equal to $243 per $100,000 of property valuation annually.

The proposed bond issue would provide the district with $78.3 million to construct, improve, furnish and equip three new middle schools and an addition to Groveport Madison High School if passed.

The 6.9 mill operating levy would generate funds for the day-to-day management of the district, like staffing, utilities and supplies. The bond issue would authorize the school district to issue $142 million in funding to replace and build three elementary schools, an additional preschool center, adding a third building for sixth graders and district-wide safety upgrades.

The district aims to secure funding through a bond issue to construct a new K-8 building. The district is requesting 4.3 mills, which equates to $151 per $100,000 of the council auditor's appraised value.

Voters in Marysville can expect to see a 5.5 mill emergency levy on the ballot on Election Day. Superintendent Diane Allen and the district’s treasurer, Todd Johnson said it would generate around $6.4 million annually, and allow the district to sustain its operations in the next five years. Read more about the levy here.

Voters in Reynoldsburg will decide on a 6.65 mill emergency levy placed on the ballot by school leaders.

The money would be used for constructing school facilities and renovating, improving and constructing additions to buildings. The ballot measure does not specify what schools would be improved. The ballot measure states that the bonds would be up to $140 million that would be repaid annually over a maximum of 37 years.

The measure also includes two levies. One of them, a 1.66 mill levy, would amount to $58 for each $100,000 of the appraised value. It would help pay the annual debt charges on the bonds. The second levy, 4.9 mills, would pay for current operating expenses, according to the ballot measure. It would cost Westerville residents $172 for each $100,000 of the appraised value. Read more on the bond, tax levies here.