COLUMBUS, Ohio — The largest technology companies in the world went on a hiring spree when the pandemic put more demand onto online services. The need for all those positions, according to Silicon Valley are no longer needed now.

Tech leaders Microsoft, Alphabet (Google’s parent company), Amazon, Meta (Facebook’s parent company) have slashed tens of thousands of jobs since the end of 2022 and the beginning of 2023.

But it is not just the internet giants, hundreds of other tech companies have given a large percentage of the work force the boot.

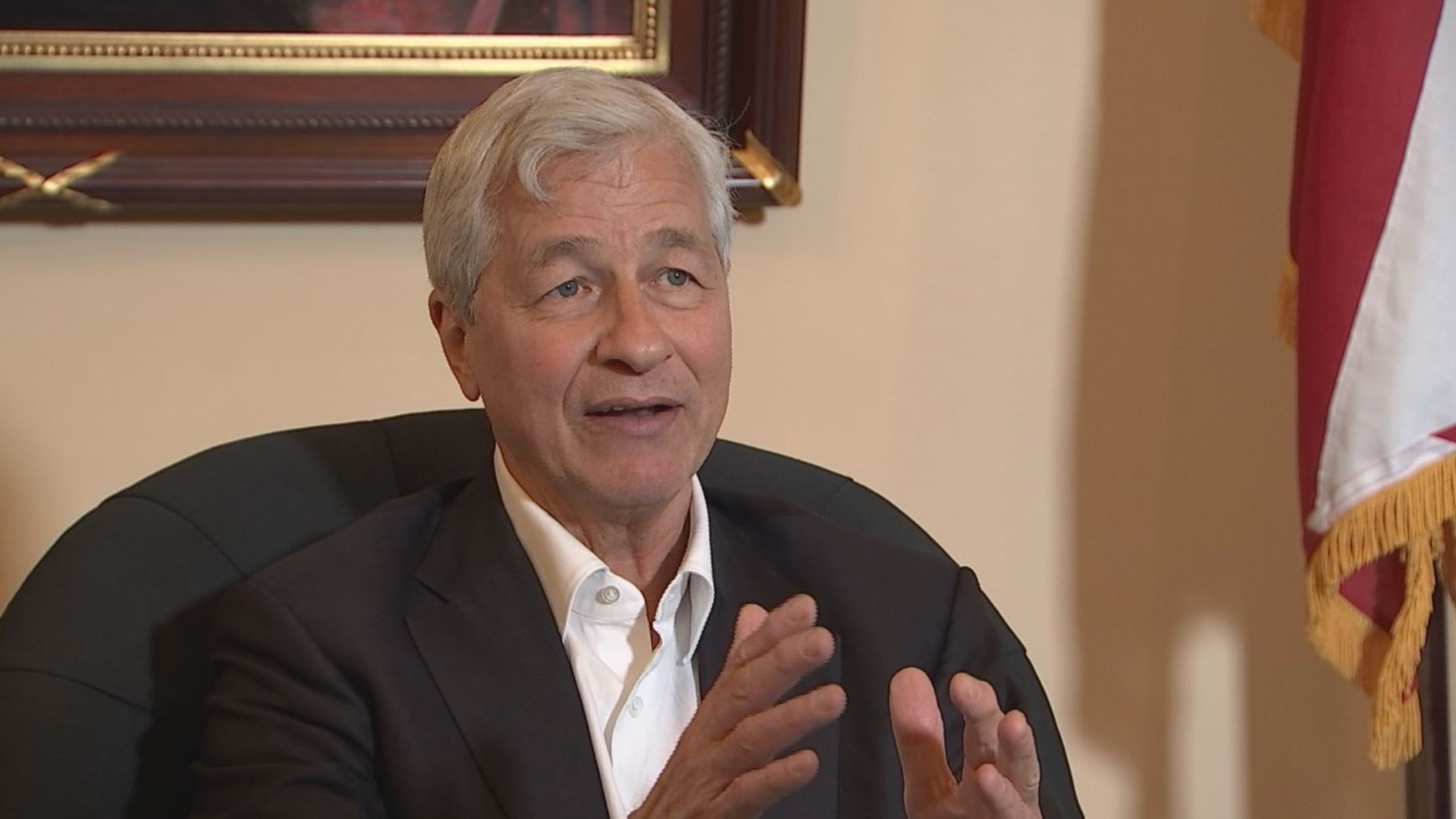

JPMorgan Chase CEO and Chairman Jamie Dimon says the company has ‘morphed’ into thinking like a FinTech company. 10TV’s Clay Gordon asked Dimon if cuts were coming for tech workers at the largest bank in the United States, with more than 20,000 employees in Ohio.

“We've been making consistent investments, forever, in technology,” Dimon said. “I think we have 55,000 people in technology today, my guess is it will not go down. There may be certain tech jobs that disappear. And we still use some very old programming that one day will be sunset. Things will change over time companies have to morph there's no one rule that how you have to do things.”

10TV reached out JPMorgan Chase to see if there were cuts to mortgage jobs. A spokesperson issued this statement:

“We regularly review our business and customer needs and adjust our staffing accordingly – creating new roles where we see the need or reducing positions when appropriate. We continue to hire in many other areas and work hard to redeploy impacted employees. In the last year alone, we added more than 22,000 jobs.”

Dimon on the economy, recession, and inflation

If you are looking to get a forecast on if we are heading into a recession, Jamie Dimon says there are some positive indicators, and negative data points to look towards.

“The economy today is actually kind of strong consumers have money,” Dimon said. “They're spending the money they have, a lot in their checking accounts, jobs are plentiful, wages are going up with the low-end business in pretty good shape. There are some negatives out there, home prices have come down a little bit, which is actually good for some people and it all that's been eroded by inflation.”

10TV’s Clay Gordon asked Dimon if it too early to declare victory on inflation, now that is has cooled of to 6.4% in January. Here is how he rates the Federal Reserve on handling inflation so far.

“I think they're doing the right thing. I hate to second guess officials because they make decisions, but it was clear that it was a little, ‘day late, dollar short,’ and there was too much quantitative easing (QE) and too much fiscal stimulus.

Now Dimon thinks they should hold off on raising rates, at least for now.

“We have to think about is that pause may not be enough, it may be they’re going to raise rates a little more later in the year, because as I said, too much fiscal stimulus is still kind of surging through the system. And QE was so large, that that's a pretty big reversal. QT (Quantitative Tightening) today, we've never had QT. So we're going to learn what's really like to have real QT.”

Central Ohio in the eyes of Wall Street and Silicon Valley

“It's kind of booming,” Dimon told 10TV’sClay Gordon about how central Ohio is impacting the future of business in the country. “You don't get Intel, I forgot the number, like $20 billion or $30 billion, Amazon to buy 400 acres here. It's kind of booming, which is great for the people here and it'd be great for jobs and great for the economy. And if I were you guys, keep it up, other states should learn what to do and what not to do by looking at the Ohio policies.”

To hear what Jamie Dimon said on the role of government with aid to Ukraine, and current diplomacy with China click on last week’s coverage here.

Watch the entire interview with Jamie Dimon here: