COLUMBUS, Ohio — Thursday is the last day for Ohioans to take advantage of the state's sales tax holiday.

The tax holiday began on July 30 and there were a few changes this year, including the extension of tax-free days.

Earlier this year, Gov. Mike DeWine announced that he extended the annual sales tax holiday for 2024 to 10 days. It will start at midnight on July 30 and last until 11:59 p.m. on Aug. 8.

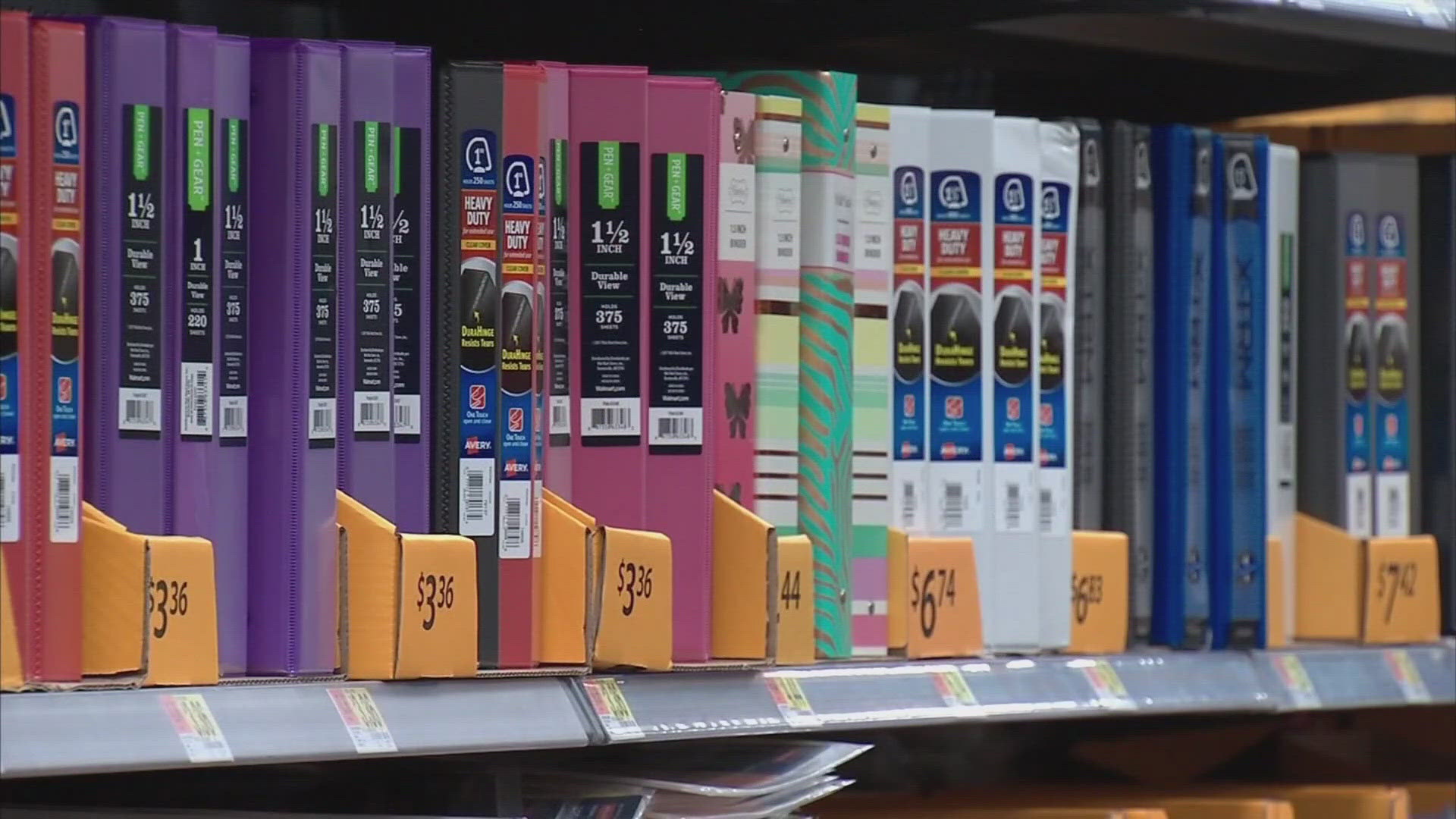

The state’s sales tax holiday, which began in 2019, lasted three days and took place on the first Friday, Saturday and Sunday of August each year. School supplies, school instruction materials up to $20 and clothes up to $75 were eligible for tax-free purchases.

“Ohio’s sales tax holiday, historically, has been meant to help families buy clothing and school supplies for the upcoming school year,” said DeWine. “This expanded sales tax break will help Ohio’s families with back-to-school necessities as well as other substantial purchases during a time when so many household budgets are being strained.”

RELATED: Ohio's sales tax holiday extended to 10 days; now includes items beyond school supplies and clothing

Here’s what you need to know about this year’s holiday:

Vendors must comply with the holiday as it is set by law, according to the Ohio Department of Taxation’s website.

What items qualify?

Ohioans can make tax-free purchases in person or online on eligible items of up to $500.

What items do not qualify?

The sales tax holiday will not include tangible personal property that is over $500. The sales tax holiday does not include the purchase of watercraft, outboard motors, motor vehicles, alcoholic beverages, tobacco, vapor products or items that contain marijuana.

Will the tax exemption apply to layaway sales?

Qualifying items placed on/ picked up from layaway during the sales tax holiday are exempt from sales tax.

Will this apply to online sales?

Qualified items sold by mail, telephone, e-mail, or Internet qualify for the sales tax exemption if the consumer orders and pays for the item and the retailer accepts the order during the exemption period for immediate shipment, even if delivery is made after the exemption period. However, if the order and payment were made before the sales tax holiday, even if the item was delivered during the sales tax holiday, it would not qualify for the exemption.

If an Ohioan is charged sales tax erroneously, that resident may file for a consumer direct refund, directly with the Department of Taxation. Sales Tax Refund forms can be found here.

Other common questions and answers can be found on the department of taxation’s website.