COLUMBUS, Ohio — Columbus City Schools leaders made a push Tuesday morning in an effort to gain support for a tax levy that will appear on the ballots of people living within the CCS district in November.

The levy, worth nearly $100 million annually, would cost taxpayers nearly $270 per $100,000 of taxable property value each year.

“We also know this is a tremendous ask of our community. It will raise taxes, but this is the time,” said Jennifer Adair, President of the Columbus City Schools School Board. "Reinvestment from this levy is critical. Many of our one-time funding sources are ending. We want to make those reinvestments to support our children and families going forward.”

The school district claims the extra money is needed to maintain the district's buildings and give students better learning opportunities. The average school building in CCS is 45 years old; the oldest is fast-approaching 130.

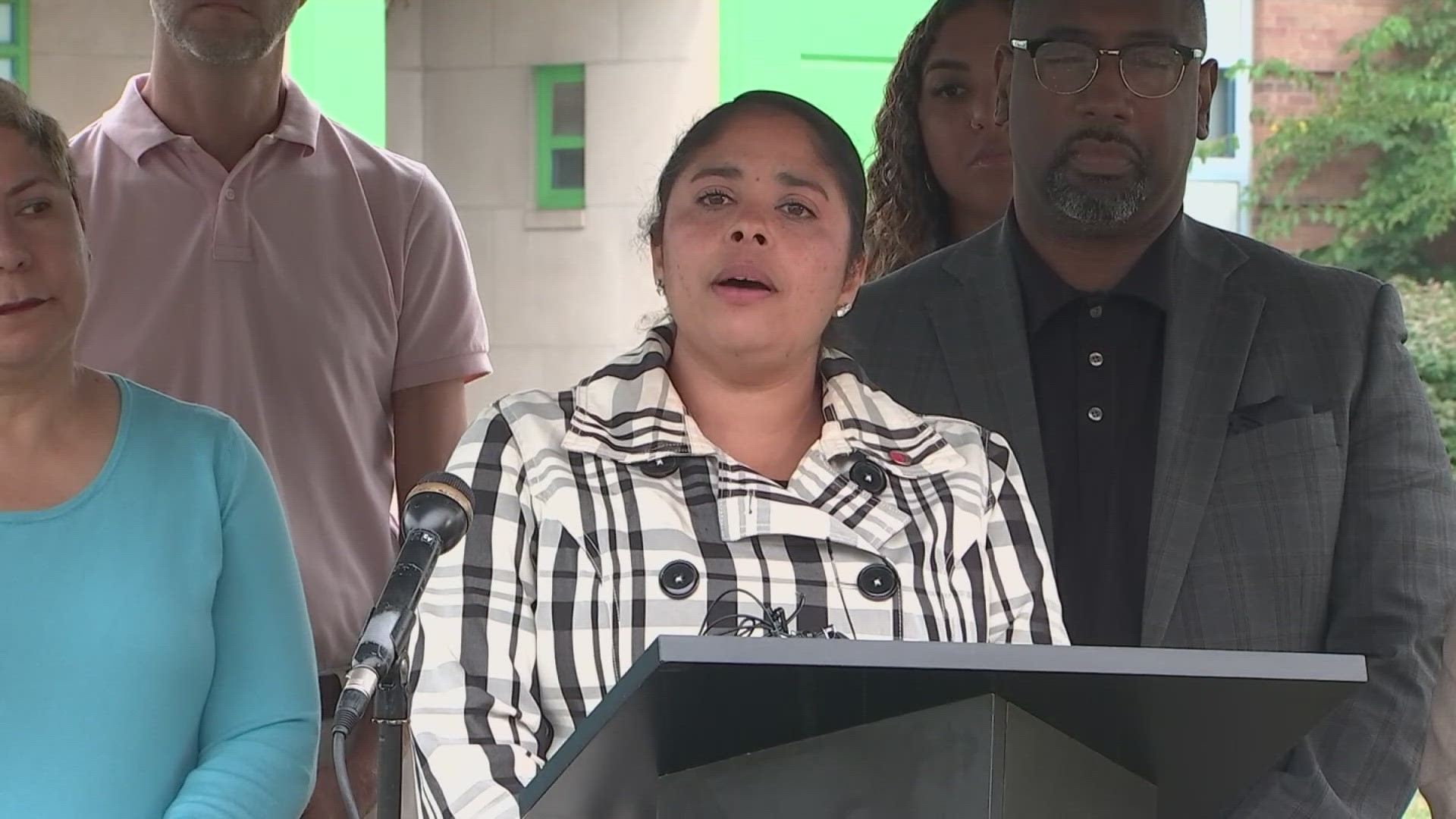

“Our community is building an economy for 2023, but our students are learning in schools built for 1923. Today’s Columbus City Schools students are tomorrow’s leaders and innovators, and without this year’s school levy, our schools won’t be able to provide the opportunities they deserve,” said Sharon Kim, a CCS parent and member of Columbus Education Justice Coalition.

Brittany Price, a mother of a third grade student in CCS, said there are disparities between district buildings. Some students might have the latest and greatest, while other students are faced with challenges in their school buildings.

"She's [her daughter] gone to summer schools that have issues with the HVAC systems, issues with teachers not being there. She's probably gone to six different schools throughout her career, so I've seen the disparities in the schools depending on what zip code you're within,” said Price.

Columbus voters passed a $125 million annual levy back in 2016. That money was used to bring the district’s aging facilities up to date and catch up on deferred maintenance.

"While the district and the board will have to take a hard look at what will have to happen, we will have to cut if this levy does not pass,” said Adair.

Adair highlighted that emergency COVID-19 money from the federal government is set to expire in the fall. The district has been leaning on that one-time funding to provide additional resources to students.

Daizhon Cox, a 2022 graduate of CCS, said he got a full ride to The Ohio State University by going through the district and believes the district needs the money to grow as the city grows.

"We have to make the investment, especially when you see the state of Ohio thriving as it is. For Columbus, we want our students to be able to compete with the best, to be the best," said Cox.

Not everyone is on board with the tax levy push.

Nana Watson, President of the Columbus Chapter of the NAACP said the additional tax burden in a year where property assessments already saw record increases will be too much for many families.

"Black people living in the central city will move because taxes are going to be so very high. Young people buying homes aren't going to be able to afford this,” said Watson.

She said the district needs to look at other sources of revenue first before turning to the tax levy.

CCS is the largest school district in the state of Ohio with 45,327 students in 113 schools. The budget for the school district is about $1.8 billion yearly.