One man shared a word of warning on Thursday about receiving a credit card that he did not request and what to do if it happens to you.

It is one thing to get an unsolicited credit card offer, but it is another to receive an unsolicited credit card itself, Consumer 10's Kurt Ludlow reported.

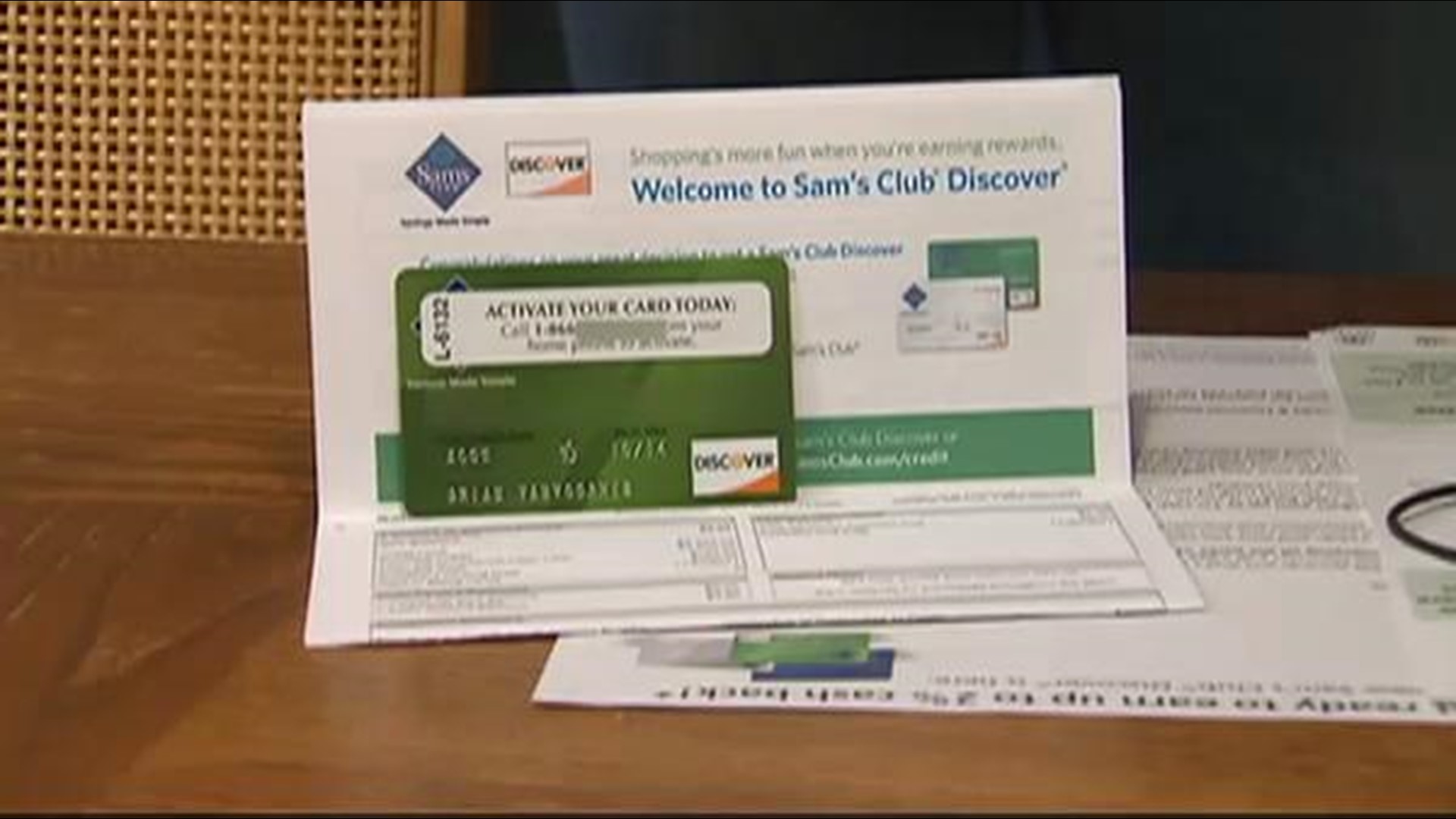

Brian Van Voorhis does not think much of credit cards or credit card offers. So imagine his surprise when he opened an envelope and discovered a Discover Card with his name on it.

Along with the card came a letter congratulating him on his decision to get the Sam's Club Discover Card, Ludlow reported.

Van Voorhis said that he called to complain because he had never requested the card.

"They said that they had previously sent me a letter which, I'm sure, looked much like an offer for a credit card, which I again, shred, and dispose," Van Vooris said.

In that letter, a Sam's Club representative would later tell Van Vooris was an "opt-out" form that he was supposed to fill out and send in to let the company know that he did not want the card.

In a statement released to Consumer 10, Sam's Club officials said that they "understood that not every letter in the mail will be opened," and said that Van Vooris' credit score would not be impacted.

While the Federal Truth in Lending Act prohibits companies from sending consumers unsolicited credit cards, it does not prevent them from requiring you to opt-out before they do send one, Ludlow reported.

"I think they're trying to take advantage of a lot of folks who would most likely say 'Gee, I've got the card now. Might as well use it and spend it,'" Van Vooris said. "That's not how I operate."

Watch 10TV News and refresh 10TV.com for more information.

Credit Card Companies Use Loophole To Send Unsolicited Cards

Some people open their mailbox to find credit cards with their names on them, even though they never wanted the card. Get the story.